The energy spdr has more assets under management than any other energy sector etf and its portfolio of energy stocks spans the entire industry.

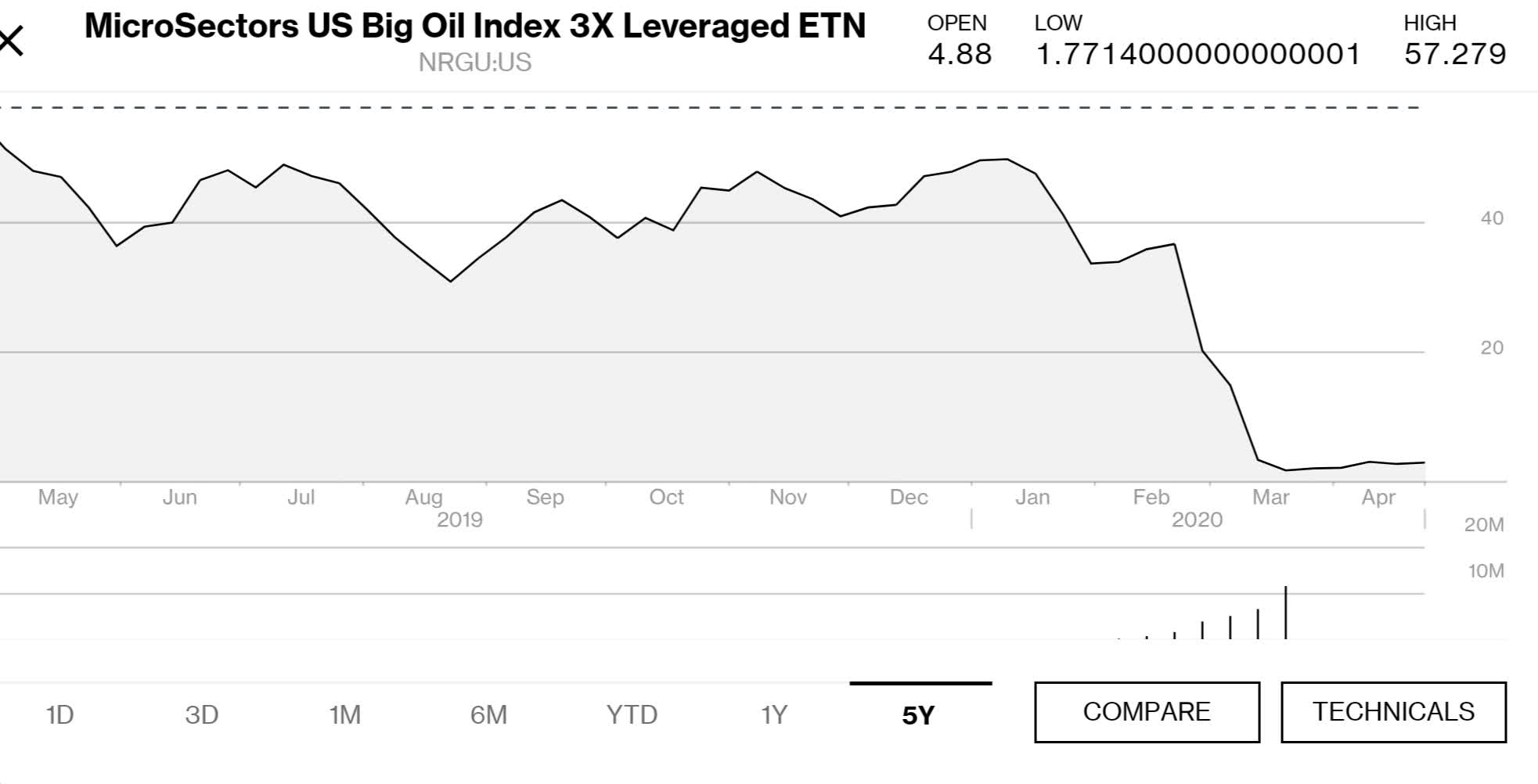

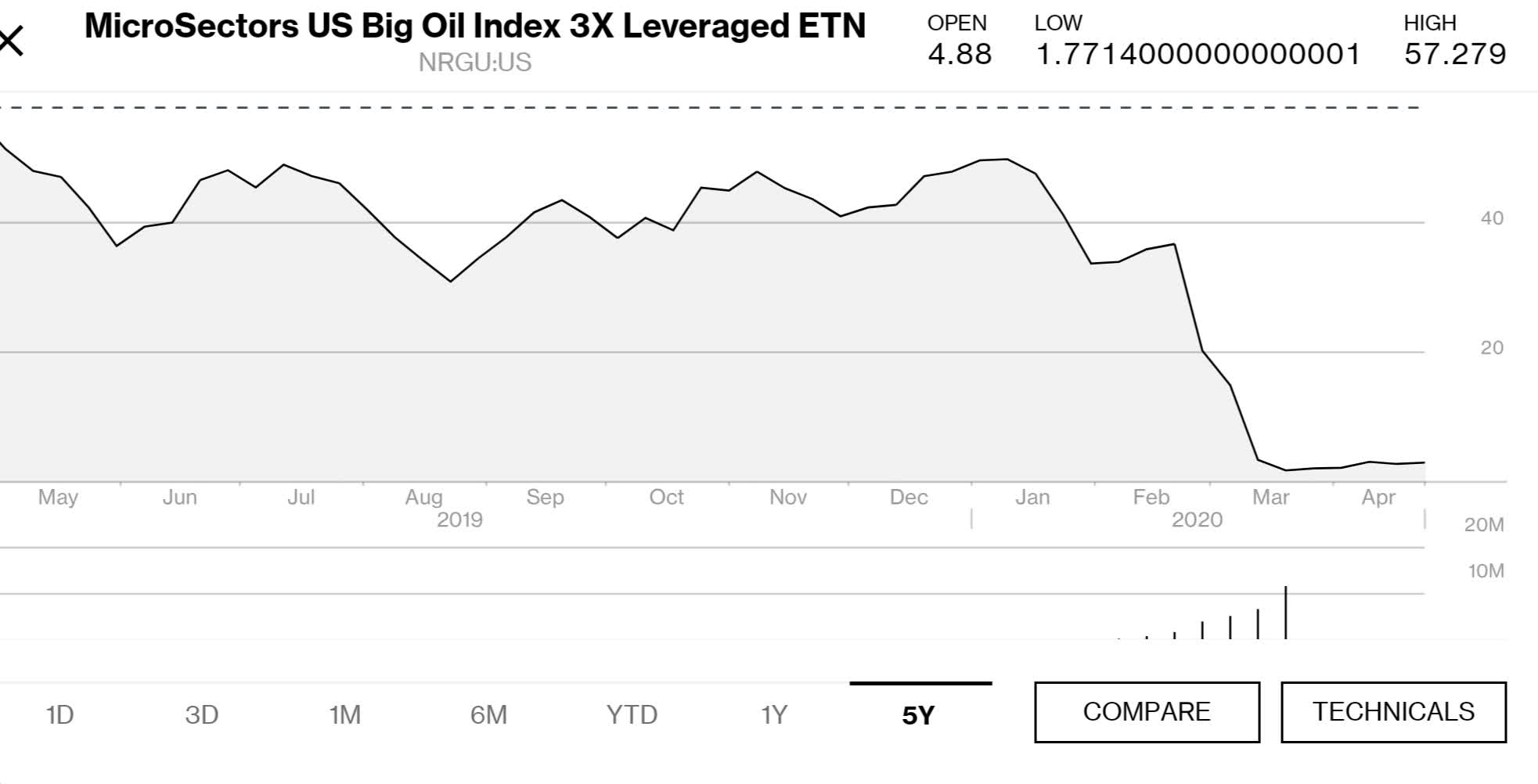

Energy sector 3x etf.

The level of magnification is included in each fund s description and is generally 2x or 3x or 2x or 3x.

More double gold etf.

In the last trailing year the best performing energy etf was the drip at 399 21.

Etfs which are available to individual investors only through brokers and advisers trade like stocks on an exchange.

It has aum of 97 1 million and trades in good volume of nearly.

Different indexes can use different classifications systems.

Click on an etf ticker or name to go to its detail page for in depth news financial data and graphs.

Equity sector etfs are popular among investors who want targeted exposure on a sector by sector basis including energy financials health care technology utilities and more.

Click on the tabs below to see more information on leveraged energy etfs including historical performance dividends holdings expense ratios technical indicators analysts reports and more.

The energy sector as measured by the energy select sector spdr etf has dramatically underperformed the broader market with a total return of 34 7 over the past 12 months compared to the s p.

An exchange traded fund or etf is an investment product representing a basket of securities that track an index such as the standard poor s 500 index.

Click on the tabs below to see more information on leveraged 3x etfs including historical performance dividends holdings expense ratios technical indicators analysts reports and more.

The largest energy etf is the energy select sector spdr fund xle with 9 33b in assets.

Leveraged and inverse equity sector etfs.

The energy sector is a category of stocks that relate to producing or supplying energy i e oil and gas drilling and refining or power utility companies.